Navigating Student Debt

If you’re a junior or senior considering going to college, the financial impact may be a concern for you. After all, there are a lot of factors involved in student loans; interest rate, repayment options, cosigning, assistance plans, and credit, just to name a few.

Many people don’t know what any of these terms mean, much less how to decide their best financial options. Hopefully, this article will make it a little easier to navigate the complexities of student loans.

As mentioned before, you probably don’t know what half the terms mentioned at the beginning of the article mean. These are all the terms you’ll need to know as they relate to student loans:

Loan – an agreement between you and another entity (person, bank, etc.) to have the entity give you money with the condition that you pay the full amount (plus any interest) back

Interest rate – the rate at which the money you owe grows

Fixed interest – the interest rate of your loan stays the same for your entire loan

Variable interest – the interest rate of your loan changes from month to month; while it may start lower than a fixed interest rate, it may become higher later

Compound interest – a type of interest that “rebases” every time a certain amount of time passes. Here’s an Explanation by Investopedia

Credit – a determination of how well-qualified you are in paying off loans, bills, etc. usually in the form of a “credit score,” or a number that shows how likely you are to repay debt

-

- Credit agencies are responsible for determining your credit score. A FICO score is the most common metric used to do this, and was created by the corporation of the same name (Fair Isaac Corporation).

- Investopedia (again) has a great article that explains what a FICO score is, how its used, and what “bad,” “decent,” and “good,” FICO scores are.

Repayment options – refers to the options your lender provides to pay back your loan

-

- For example, one type of repayment option is a “Standard Payment Plan,” where payments are predetermined and don’t change as you pay off your loan over a ten-year period.

Refinancing – the option to combine a bunch of separate loans into one, which may allow you to lower the amount you need to pay as well as make it easier to manage

Cosigning – the process by which someone (the cosigner) signs an agreement to pay your debt should you (the borrower) not be able to

Cosigner Release – the process for a cosigner to be removed from an existing loan; having this option makes people more willing to cosign since they can shift responsibility for the loan onto you once you’re financially stable

Calculating Debt

Before calculating your debt, there are a few more terms you need to know.

Debt is the amount of money that you owe for a loan. To calculate how much you’ll need to pay with a compound interest loan over a certain number of years, use the formula:

Amount=P(1+rn)nt

- P is the initial amount you needed to owe.

- r is the interest rate in decimal form (e.g. 5% → 0.05)

- n is the compounding rate, or the number of times a loan compounds over a period of time

- t is how many times the period of time used in your compounding rate has passed

This is also explained in the Investopedia article about compound interest mentioned in the dictionary.

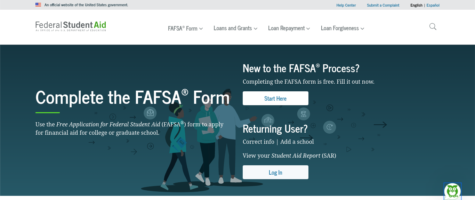

FAFSA and Student Aid

FAFSA, or the Free Application for Federal Student Aid, is an application given out for free by the government to see what aid (help with your finances) students qualify for. When you fill out the FAFSA, you will list the ten colleges you’re applying to (or most want to get into if you applied to more than ten colleges).

Those colleges will then send you an “award letter,” which details what federal and nonfederal aid the college is offering you.

Nonfederal aid refers to any aid that doesn’t come directly from the U.S. government; this can mean state aid, scholarships, and private-sector loans. Federal student aid can come in three forms: a grant, a loan, or a work-study.

- A grant is “free money;” it is deducted from your applicable student expenses without any need to pay money later.

- A loan is a money given to you by the government to cover student expenses that you will have to pay back with interest post-graduation.

- Work-study provides students that have the financial need with at least a minimum-wage job to help pay for student expenses. These jobs can involve working for your school, a nonprofit organization, or a public agency.

You can find more information about the different types of federal aid at https://studentaid.gov/understand-aid/types.

Choosing the Best Loan

Once you have a list of loan options , you should filter the list to find the loan that suits you best. The terms of the loan should generally meet these requirements:

- The loan has a manageable interest rate.

- Your method of repayment is permitted in the terms of the loan and matches how you plan to earn money.

- For private loans only: Your credit score is above the required score or the loan allows for cosigners and cosigner release.

Before even considering private loans, only consider government loans and aid. Government loans almost guarantee a better interest rate, more flexibility in terms of repayment, and potential tax benefits (for example, deducting your interest from your taxes).

Once you have a list of options, there is no one-size-fits-all course of action. However, there are still a lot of criteria you can consider:

- Which loan (or combination of loans) has the best interest rate?

- Which loan has the best benefits (if any)?

- Is financial assistance available for the loan?

- Is refinancing available for the loan?

After finding the best loan(s) for you, it’s very important to make sure what you’re going to college for will put you on course for a career that will make you enough money to pay back the loan.

Refinancing

If you took multiple loans, combining them all into one loan has the potential to lower your interest rate and/or the amount you need to pay per month by extending the loan period.

Many resources for refinancing exist online, such as LendingTree, which can help with determining whether or not you should refinance as well as a calculator to see what your monthly payments will look like afterward.

Navigating student loans is very complex. With this guide for how to navigate student loans and the finances it involves, you will now be more prepared to enter the college world.

I write about money and tech. I also have an interest in sports and math.